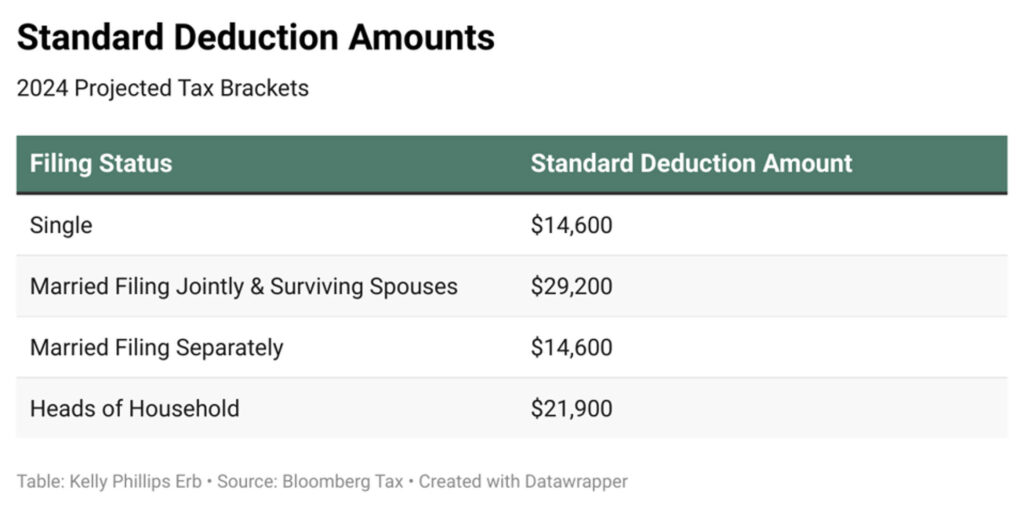

2025 Tax Brackets And Standard Deduction. The standard deduction amounts will increase to $14,600 for individuals and married couples filing separately, representing an increase of $750 from 2025. Heads of households will see their standard deduction jump to $21,900.

The standard deduction for a single person will go up from $13,850 in 2025 to $14,600 in 2025, an increase of 5.4%. Heads of households will see their standard deduction jump to $21,900.

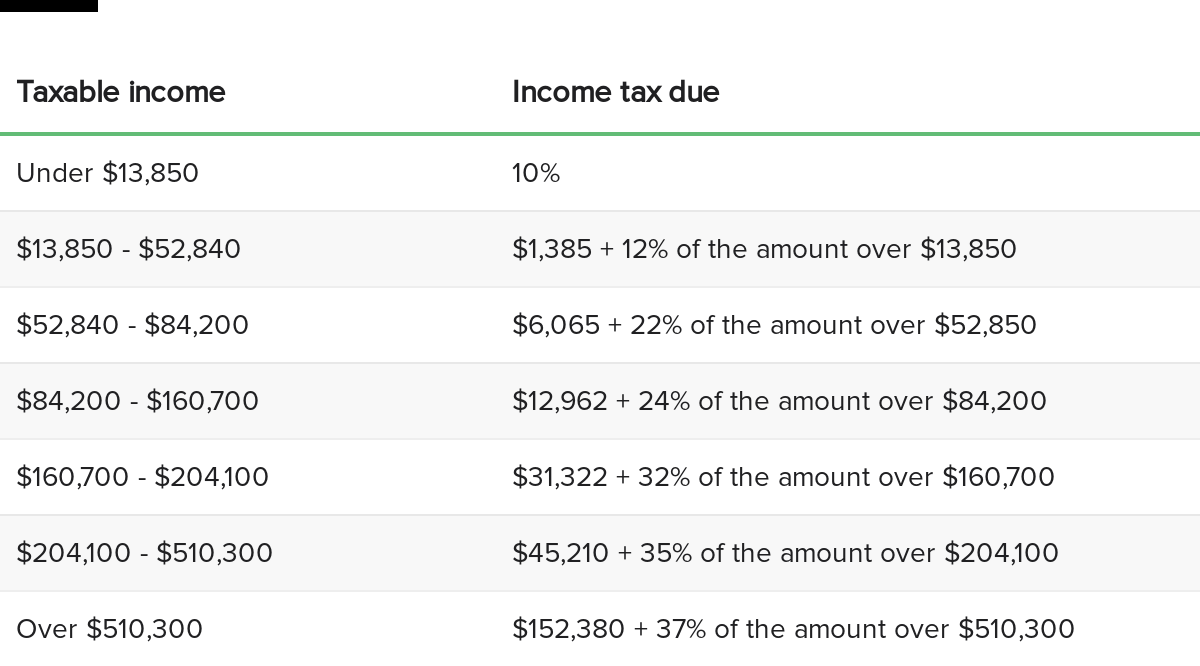

Along with the new standard deduction amounts for 2025, the irs also released new 2025 federal income tax brackets.

2025 Standard Deductions And Tax Brackets Bren Sherry, Your bracket depends on your taxable income and filing status. You pay tax as a percentage of your income in layers called tax brackets.

2025 Standard Deduction Over 65 Tax Brackets Britta Valerie, The federal income tax has seven tax rates in 2025: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Usa Tax Brackets 2025 Idette Karole, The internal revenue service (irs) adjusts tax brackets for inflation each year, and because inflation remains high, it’s possible you could fall into a lower bracket. The standard deduction amounts will increase to $14,600 for individuals and married couples filing separately, representing an increase of $750 from 2025.

Standard Federal Tax Deduction For 2025 Cati Mattie, Single or married filing separately: The standard deduction for a single person will go up from $13,850 in 2025 to $14,600 in 2025, an increase of 5.4%.

2025 Tax Brackets Mfj Limits Brook Collete, The top marginal tax rate in tax year 2025, will. Your bracket depends on your taxable income and filing status.

2025 Tax Brackets And Deductions Mela Stormi, The standard deduction for a single person will go up from $13,850 in 2025 to $14,600 in 2025, an increase of 5.4%. For single taxpayers and married individuals filing separately, the standard deduction will rise to $14,600 for 2025, up $750 from this year;

Your First Look At 2025 Tax Rates Projected Brackets,, 52 OFF, The 2025 standard deduction amounts are as follows: For individuals, the new maximum will be $14,600 for 2025, up from $13,850, the irs said.

IRS unveils new tax brackets, standard deduction for 2025 tax year, You pay tax as a percentage of your income in layers called tax brackets. 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent.

Your first look at 2025 tax rates, brackets, deductions, more KM&M CPAs, For single taxpayers and married individuals filing separately, the standard deduction will rise to $14,600 for 2025, up $750 from this year; Standard deductions for 2025 the 2025 tax year standard deductions will increase to $29,200 for married couples filing jointly, up $1,500 from $27,700 for the 2025 tax year.

These Are the New Federal Tax Brackets and Standard Deductions for 2025, Standard deductions for 2025 the 2025 tax year standard deductions will increase to $29,200 for married couples filing jointly, up $1,500 from $27,700 for the 2025 tax year. The 2025 standard deduction amounts are as follows: